Current Home Equity Interest Rates

Table Of Content

For a more tailored approach, California Credit Union, California Coast Credit Union and Credit Union of Southern California are local options, each with distinct features that could serve your needs well. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Your home has equity when its current value is more than what you owe. When you have equity in your home, you don’t have to pay it back. CU SoCal does not provide and is not responsible for the product, service or overall website content available at these sites.

The Fed and its impact on home equity rates

Public input on housing priorities helping Knoxville create Fair Housing Equity Plan - WATE 6 On Your Side

Public input on housing priorities helping Knoxville create Fair Housing Equity Plan.

Posted: Sun, 28 Apr 2024 10:32:32 GMT [source]

That said, you should understand that defaulting could put your property at risk of foreclosure. So while using your home as collateral could mean an easier approval process, it also has its potential downsides to consider beforehand. Even further, even a nondischargeable judgment can be avoided if it impairs an exemption under 522(f), with many courts citing to In re Ash, 166 B.R. We highly recommend consulting with bankruptcy attorney who can assist you in obtaining the most favorable outcome in your case.

How much can you borrow with a home equity loan?

We help marginalized communities enact plans to stop the cycle of poverty through mentorship and empowerment programs. Ms. Apel, a retired law professor, is having trouble climbing stairs. Mr. Irwin, 71, previously an account manager for a local business, is wearying of yard work and snow shoveling, and finding workers to do those chores instead has become difficult. When it came to housing, Susan Apel and Keith Irwin thought they had planned adroitly for later life. They bought a four-bedroom house on two acres in Lebanon, N.H., 24 years ago, and “we made sure to pay off the mortgage before we retired,” said Ms. Apel, 71. How to applyYou can fill out a lead form online, but you will need to meet with a Fifth Third Bank representative in person or speak to one over the phone to complete the HELOC application.

What California’s New Homestead Exemption in AB 1885 Means for Homeowners

Similar to a home equity loan, you can access the equity in your home through a home equity line of credit (HELOC). A HELOC is different from a loan because you withdraw the money as needed. Instead, you pay interest only on the funds you have taken out. HELOCs typically charge adjustable interest rates, so your monthly payments vary based on changes in interest rates. Home equity loans allow homeowners to borrow against the equity in their homes.

Bankrate is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or when you click on certain links posted on our site. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to strict editorial guidelines.

Apply Now

If the sale price doesn't cover all of the equity you have in the property, then the leftover amount is a "gift of equity." It's essentially a discount on the property. If you think this might apply to your situation, you should check the current gift tax thresholds to learn about potential liabilities. The more you put down, the smaller your loan balance will be—meaning more home equity. You can experiment with the effect by using our mortgage calculator. Upgrading your home and making smart improvements can also increase its value and therefore your equity stake. For example, you might spend $50,000 on remodeling your kitchen, which might increase the market value of the home by $30,000—assuming that you didn't take out a home equity loan to pay for the new kitchen.

Bank of America offers fixed- and adjustable-rate conventional and jumbo mortgages (ARMs), FHA loans and the Affordable Solution Mortgage, which requires just 3% down and no private mortgage insurance. PNC also offers a full digital pre-approval application, where borrowers may apply online and receive approval in a matter of minutes. A 750 score is considered a "very good" credit score, according to FICO. With a 750 credit score, your mortgage approval odds are good (provided the rest of your finances are strong) and you'll likely get a better rate.

Even though your home belongs to you, your lender secures the loan against the property until you’ve repaid in full. Your potential home equity loan rate depends in part on where your home is located. As of April 24, 2024, the current average home equity loan interest rate in the five of the largest U.S. markets is 8.63 percent. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate.

What Can I Use a Home Equity Loan For?

In other words, debtors may maximize their exemptions, even when they do so shortly before the filing of a bankruptcy petition. 778, 782–83 (Bankr. D. Idaho 2012) (also discussing exceptions to this rule). Another benefit of home equity loans is that they have competitive interest rates, which are usually much lower than those of personal loans and cash-out refinances. Home equity is the stake you have in your property – the percentage of the home you own outright. Over time, you build up equity in your home as you make payments on your mortgage or your home’s value rises.

No matter which lender you choose, borrowers with higher credit scores and lower debt-to-income ratios are more likely to qualify for the best rates. A cash-out refinance refers to using your equity to get a new mortgage that's larger than the amount owed on your existing mortgage. Then, you pay off the existing mortgage and use the remaining money as needed. As with home equity loans and lines of credit, the funds are tax free because they're viewed as debt by the IRS, not income. In addition, you’ll want to compare annual percentage rates (APRs), which more accurately represent the total cost of the loan, as well as customer reviews of the lender. When evaluating home equity lenders, consider what type of loan experience you want (online or in-person), how much equity each lender requires you to have and what fees and commissions they charge.

At Equity Union we provide seamless, elevated service to our Agents, so they can give their clients the same. Connect with an Agent today and experience the Equity Union difference. We may receive commissions from some links to products on this page.

This article was featured by the LA County Bar’s LA Lawyer Magazine. Borrowers in California can see that their HELOC APR varies with factors like credit scores and LTV ratios under 80%. Compare using the table to see rate changes according to selected parameters. When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Loan details presented here are current as of the publication date. Check the lenders’ websites to see if there is more recent information.

A home equity loan is best used for a repair, renovation or project that will add to the value of the home. Census Bureau’s 2021 American Housing Survey report shows that the average project (or series of projects) financed by a home equity loan cost $11,240. The report also shows that the kitchen tends to be the most expensive room to renovate, with homeowners spending a median amount of $35,000. Unlike some investments, home equity cannot be quickly converted into cash. That's because the equity calculation is based on a current market value appraisal of your property. That appraisal is no guarantee that the property would sell at that price.

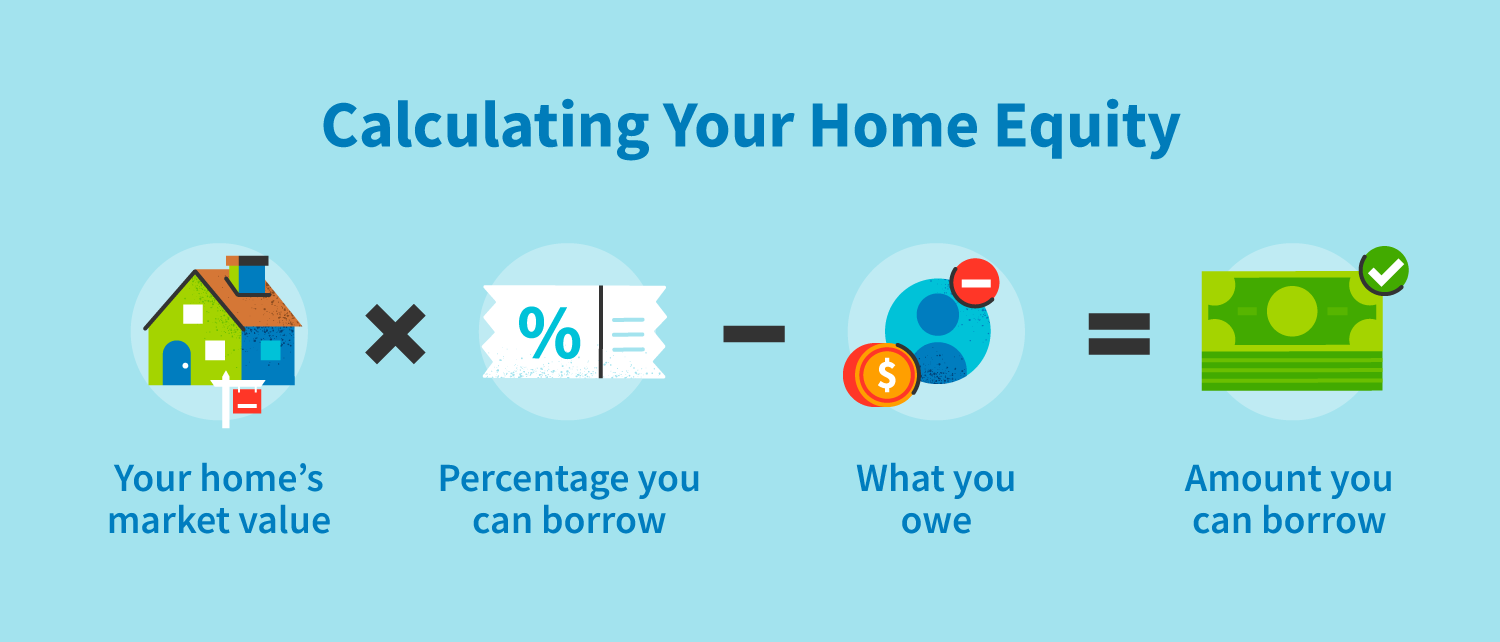

You can use your home equity and the funds you borrow to your financial benefit. Equity is the difference between what a home is worth and what's owed on a mortgage loan. The five funds have committed to standards that promote unionization, the ability to negotiate union contracts, workplace safety standards, and the elimination of the use of forced labor, including child labor. If you decide to cancel your loan, you must inform the lender in writing by mail or delivery before midnight on the third business day. For more information, visit the Federal Trade Commission website.

Your combined loan-to-value (CLTV) ratio is the sum of any loans or debts you owe on the home—such as a first mortgage, second mortgage or home equity loan—divided by the home’s value. For example, if you have a $200,000 mortgage plus a $50,000 home equity line of credit, and your home is worth $300,000, your CLTV is 83%. HELOCs are revolving credit lines, meaning you can make use of only the amount you need, repay it and use it again. During this time, you still have to make a monthly payment, but it is often interest only. Having multiple borrowing options to choose from, and different loan terms to opt for, allows you to customize your home equity borrowing to best suit your needs.

Comments

Post a Comment